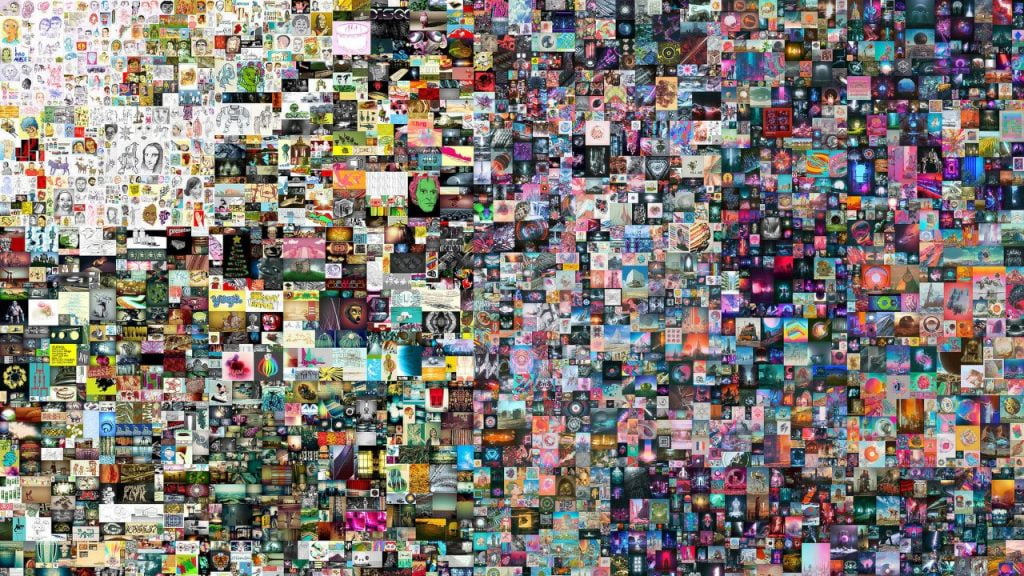

В феврале–марте 2021 года прошла волна. Цунами. Поводом стал цифровой коллаж Everydays: The First 5000 Days, выставленный на торги в Christie’s, который оказался первым чисто цифровым произведением искусства в истории этого аукционного дома. Это событие, разумеется, привлекло к себе внимание: «Кристис» – далеко не последнее имя в сфере арт-бизнеса, да и сам по себе факт появления «цифры» в респектабельном мире вполне материальных живописных полотен, фарфора, антикварной мебели с позолотой, раритетных часов и красных бутылок водки маотай выглядел как хорошо продуманная пиаровская акция, рассчитанная на острую реакцию общественности. Пиар сработал, всех интересовало, раз «Кристис» ставит на кон свою репутацию, значит оно того стоит? Значит, новомодные технологии, пока что в основном замеченные в раздувании цифровых пузырей, чёрной и серой торговле, вымогательстве, контрабанде и неприкрытом стремлении отцов-основателей многочисленных криптовалют зарабатывать ещё и на транзакциях, пригодны к чему-то полезному? Ответ был громким: 11 марта до того малоизвестный художник Бипл, создающий компьютерные иллюстрации, вырвался на третье место в списке самых дорогих ныне живущих художников, сразу после Джеффа Кунса и Дэвида Хокни.

Everydays: The First 5000 Days. 69,3 миллиона долларов США. Изображение: Beeple.

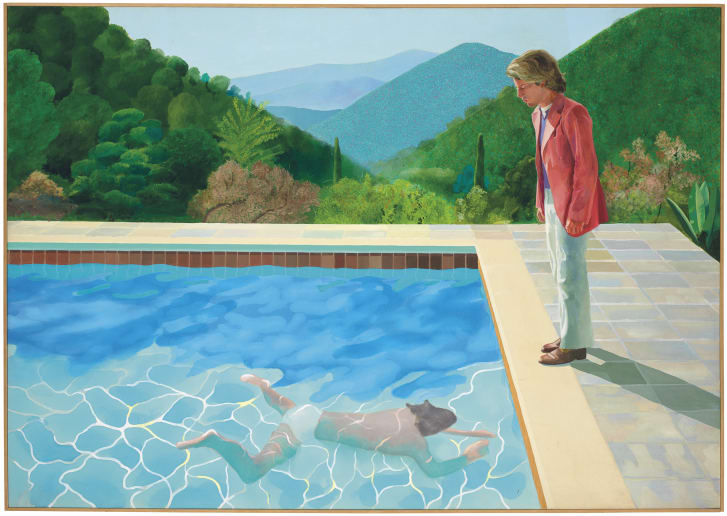

Everydays: The First 5000 Days. 69,3 миллиона долларов США. Изображение: Beeple. Безусловно, шума было необычайно много, оценки разнились невероятно, от выражения определённой уверенности, высказанной time.com, что «NFT [невзаимозаменяемые токены] потрясают мир искусства – но они могут изменить его гораздо больше», до ощутимо саркастической констатации «Файл JPG продается за 69 миллионов долларов, NFT-мания набирает обороты» – так отреагировали в nytimes.com, и откровенно негативной реакции washingtonpost.com: «Цифровое “произведение искусства” Бипла продано дороже, чем любая картина Тициана или Рафаэля. Но как искусство это большой ноль». Дэвид Хокни, занимающий вторую строчку в том самом списке, близок к позиции washingtonpost.com, охарактеризовав искусство Бипла как «глупые мелочи» (буквально: silly little things).

«Крупная (213,5 × 305 см) и невероятно умная вещь»: картина «Портрет художника (Бассейн с двумя фигурами)» Дэвида Хокни. 90,3 миллиона долларов США. Изображение: источник.

«Крупная (213,5 × 305 см) и невероятно умная вещь»: картина «Портрет художника (Бассейн с двумя фигурами)» Дэвида Хокни. 90,3 миллиона долларов США. Изображение: источник. Тема, разумеется, спорная, но 69 миллионов долларов за «цифру» – это ощутимый довод в пользу того, чтобы относиться к появлению фактора блокчейна в искусстве вполне серьёзно. И желательно с пониманием, какое отношение к искусству имеют NFT, они же невзаимозаменяемые токены, да и вся блокчейн-технология. Увы, путаницу вносит даже сам термин «крипто-арт» (Cryptoart), всё чаще использующийся для идентификации этого (нового? нет) явления в искусстве. Рассматривая этот термин, прежде всего следует уточнить, что технология невзаимозаменяемых токенов NFT, как и любая другая блокчейн-технология к процессу создания произведения цифрового искусства непосредственного отношения не имеет.

Вся эта история, как представляется, сложилась из двух составляющих. Первая – это образ действий новой крипто-элиты (назовём это так), которая для повышения капитализации своей отрасли пользуется, в том числе, методами, применяемыми в создании финансовых пирамид. Кто выложил 69 миллионов за работу Бипла? Правильно, основатель криптофонда (самоопределение звучит так: crypto-exclusive fund) Metapurse из Сингапура, известный под ником Metakovan. Вторая составляющая вполне позитивна, в противоположность первой. Отличие цифрового искусства от обычного, вещного, в том, что «цифру» можно скопировать, и при этом никаких различий между оригиналом и копией найти не удастся, тогда как даже самые продвинутые технологии пока неспособны создать точную копию материального макроскопического объекта. В будущем, возможно, всё это будет, но до него, этого прекрасного будущего, надо ещё дожить. Пока что институт провенанса и атрибуции экспертным сообществом в целом удовлетворительно справляется со своей работой с материальными предметами искусства. Но у художника, создающего «цифру», есть (была?) проблема: как доказать, что он продаёт оригинальное произведение, если копия делается легко и неотличима от оригинала?

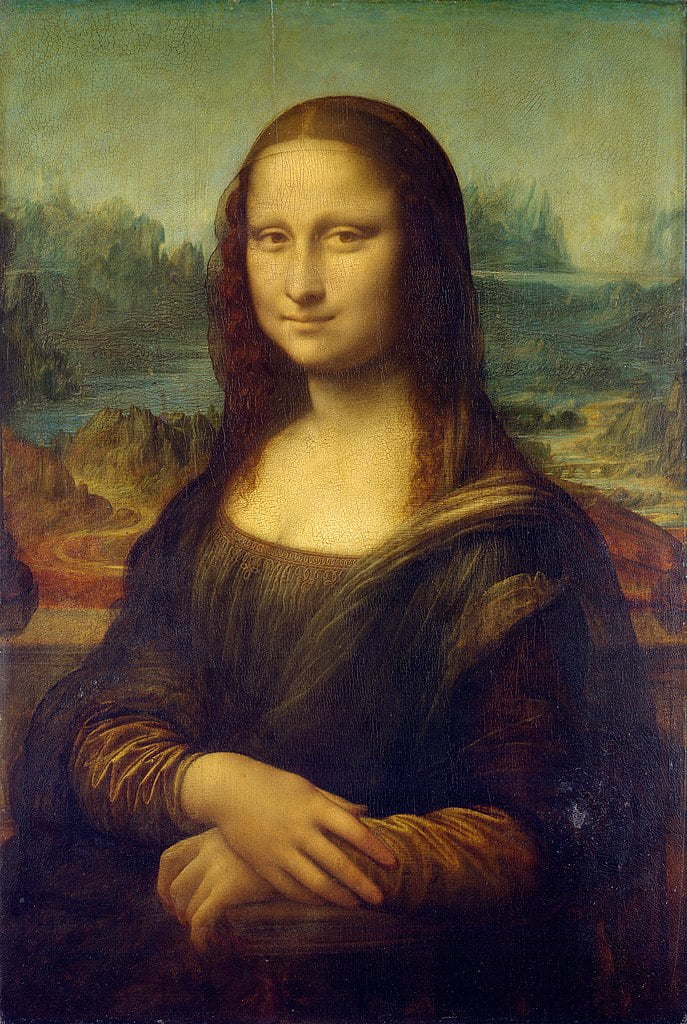

Аналогична проблема покупателя «цифры»: как доказать, что это произведение искусства принадлежит тебе, и иметь солидные непробиваемые аргументы против тех, кто заявляет это не так или допускает неавторизованное использование произведения искусства и нарушение авторских прав. В принципе, в качестве решения годится общественное согласие по каждому конкретному произведению искусства: все знают, что «Джоконда» хранится в Лувре, и все согласны с тем, что все прочие «джоконды» – это подделки либо копии.

Говорим «Джоконда», подразумеваем – «Лувр». Общественное согласие как наилучший блокчейн. Изображение: Musée du Louvre.

Говорим «Джоконда», подразумеваем – «Лувр». Общественное согласие как наилучший блокчейн. Изображение: Musée du Louvre. Однако, на каждую картинку в интернете не соберёшь всемирное общественное согласие. Блокчейн-технологии, созданные, быть может, не совсем приятными (для кого-то) людьми, это и есть технология, реализующая механизм общественного согласия в каком-то чрезвычайно хитроумном алгоритме, анализировать который нам здесь совершенно не интересно. Важно понять, что блокчейн – это некопируемая подпись художника, а также способ продать произведение искусства. Полезно ли это художникам? Безусловно. Заработают ли на новом рынке дельцы от блокчейна? Разумеется. Стоит ли из-за этого закрывать эту возможность? Даже если и стоит, кто сможет это осуществить? Игра уже сыграна, блокчейн уже проник в сферу искусства, и сейчас важно с умом распорядиться открывшимися новыми возможностями.

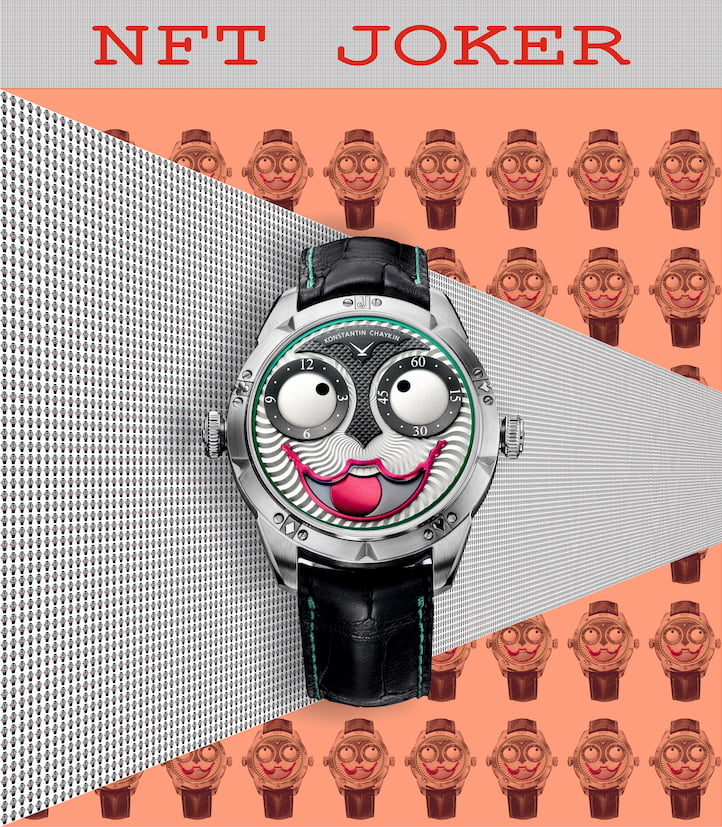

Здесь вполне законен вопрос: какое касательство всё это имеет к часовому искусству? События, последовавшие за скандальной продажей на «Кристис», показывают, что имеет, и непосредственное. Часовщики и часовые бренды живут в этом мире и реагируют на всё, что в нём происходит. Уже 25 марта 2021 года, то есть через две недели после исторического (давайте будет называть это так) аукциона, бренд Jacob & Co. объявил о продаже на блокчейн-площадке ArtGrails виртуальных часов Epic SF24, где в указателе мирового времени вместо городов будут обозначены название криптовалют, а на виртуальном циферблате появится виртуальный турбийон. 30 сентября Жан-Клод Бивер выставил на продажу на wisekey.com/wiseart «цифрового близнеца» своего собственного экземпляра (прототипа) модели Bigger Bang All Black Tourbillon Chronograph “Special piece”. Наконец, 1 апреля Константин Чайкин объявил о создаваемом им проекте NFT-Joker, где, в отличие от его коллег, нет виртуальных часов, но реализуется (процесс занимает два лунных месяца) уникальное произведение искусства. Разумеется, там фигурируют часы «Джокер», но смысл, идея и послание Константина Чайкина – о сущности времени и многоликости его образов.

Так предварительно представлен NFT-Joker Константина Чайкина. Окончательный вариант этой виртуальной картины будет скомпонован после 11 мая 2021 года.

Так предварительно представлен NFT-Joker Константина Чайкина. Окончательный вариант этой виртуальной картины будет скомпонован после 11 мая 2021 года. Блокчейн-технологии делают только первые шаги в мире высокого часового искусства, но было бы ошибкой игнорировать их или полагать их малозначимыми.